r&d tax credit calculator 2020

How to calculate RD for SMEs. RD Tax Credits Calculator.

Debt Printable Visual Chart Showing How Does A Debt Snowball Work Learn How To Use Dave Ramsey S Favorite Debt Debt Snowball Debt Calculator Money Management

2020 Current Year 140000.

. First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same period. Show how this example is calculated. You might do this as a SME if you cannot claim RD tax relief for SMEs.

If your business is spending money to create a new product or process or improve upon an existing product or process then you. 4 The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table.

Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. Call us at 208 252-5444.

If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. For profit-making businesses RD tax credits reduce your Corporation Tax bill.

What is your estimated spend on RD per year. Plus it carries forward 20 years. Compared to the ASC the RRC RD tax credit calculation may result in a larger credit under some scenarios particularly those where the base amount is low.

This is a dollar-for-dollar credit against taxes owed. Then youll need to have the following figures on hand. Startup RD Tax Credit Calculator.

Fifty percent of that average would be 24167. What is the RD tax credit worth. Copious Limited Floor 2 9 Portland Street Manchester M1 3BE.

Visit our already updated RD Tax Credit Calculator to estimate your startups possible tax credit under this new legislation. It should not be used as a basis for calculations submitted in your tax returns. The Tax Credit Calculator is indicative only and for information purposes.

So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. Total number of employees in your business. Use our simple calculator to see if you qualify for the RD tax credit and if so by.

The Inflation Reduction Act of 2022 passed August 12 2022 increases the RD Tax Credit amount from 250000 to 500000. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they would be able to reduce their Corporation Tax CT by up to 25000 ultimately deducting 130 of the. A to Z Constructions average QREs for the past three years would be 48333.

Our experienced tax team will analyze your investment in new technology development to help you get real non-dilutive cash. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion for corporations and 12 billion for individuals. We only charge IF we determine you are entitled to a tax credit.

Calculating RD relief for an SME depends on whether your business is profit- or loss-making. 70000 - 24167 45833 x 14 6417. Calculate how much your research and development claim could be worth by using our RD tax credits calculator.

RD Tax Credit Calculator Nick Tantillo 2020-02-12T2354170000. In Step Two the company determines half of this amount or 60000. Calculate RD expenditure credit.

The money companies spend on technology and innovation can offset payroll and income taxes through RD Tax Credits. We estimate you could receive up to. On expenditure incurred on or after 1.

What types of activities qualify for the RD Tax Credit. RD tax credit calculation for profit making SMEs. The rate of relief is 25.

Contact Strike to know exactly how much you stand to. How are RD tax credits calculated. We will update our websites content in the coming days.

As a tax credit. For most companies the credit is worth 7-10 of qualified research expenses. Data Protection Number ZA453238.

RD Tax Credit Calculator. On this page you can calculate the value of your Research Development tax credits claim. Registered in England Wales Company Number 11437826.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. Need help filing for your RD Tax Credit. If you spend money creating or improving products or services youre probably eligible for an innovation tax refund.

RD Tax Credit Calculation. Code 41 Credit for increasing research activities Under this provision of law a portion of the expenditure incurred by the taxpayer in carrying on research R D. For startups applying the credit against payroll taxes is a valuable non-dilutive funding opportunity.

The credit is calculated at 13 of.

Tax Payment Concept State Government Taxation Calculation Of Tax Return Man Fills The Tax Form Documents Calendar Calculat Irs Taxes Tax Payment Tax Debt

Implementation Report Template 1 Professional Templates Report Template Progress Report Template Templates

كيفية اعداد موازنة المبيعات للشركات Ecpa In 2022 Budgeting Budget Forecasting Budgeting System

Tablet Face Off Amazon Fire 7 Vs Lenovo Tab M7 Samsung Galaxy Tablet Lenovo Galaxy Tablet

100 Pass Guarantee Abap On Hana E Hanaaw 14 E Hanaaw 16 Latest Actual Exam Practice Questions Septem How To Memorize Things This Or That Questions Udemy

Form 1040 Income Tax Return Irs Tax Forms Income Tax

Sales Analysis Report Template 6 Templates Example Templates Example Presentation Example Report Template Sales Report Template

How To Buy Solana In 2022 Investing Forbes Best Investments

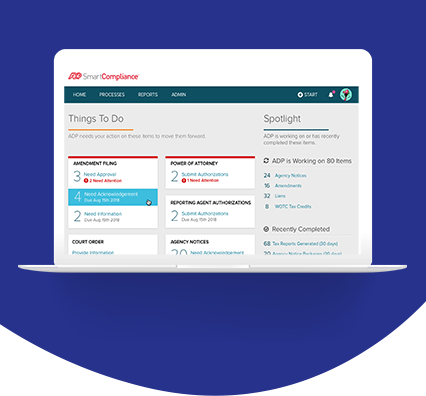

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Adp

Premium Vector Clipboard With Balance Sheet And Pen Calculator Money Balance Financial Reports Statement And Documents Accounting Bookkeeping Audit Debit Balance Sheet Accounting Cost Accounting

R D Tax Credit Calculation Adp

How To Use Your Tax Refund For A Car Purchase Roadloans Tax Refund Car Purchase Car Buying

What Is Gst Registration Online Process Goods And Services Legal Services Goods And Service Tax

Technical Report Cover Page Template 4 Templates Example Templates Example Contents Page Template Cover Page Template Word Page Template

An Essential Guide To Tax Saving Mutual Funds Elss Mutuals Funds Increase Knowledge Fund

Research Internship Human Well Being Internship Eliminate Poverty